Exhibiting your hard earned money circulate once the a business owner, builder, freelancer, otherwise gig staff member normally need a bit more documentation than the the average salaried personnel and can both feel just https://cashadvancecompass.com/installment-loans-id/post-falls/ as challenging since the paying down your education loan stability otherwise to get a home. However, if you are during the good economic position, demonstrate a strong industry trajectory, and certainly will document steady, credible cash flow whenever you are applying for that loan, getting notice-functioning ought not to stop you from student loan refinancing, to order property, or refinancing your property.

Here are our best info and things to know to simply help make you the approved offer otherwise obvious to close’ less when you are notice-operating.

Who’s a self-operating debtor?

Self-a job normally have to do with more than simply individuals who very own the own small business. It can include freelancers, developed specialists, seasonal efforts, and other front side occupations you to earns money and you will looks such one of many after the scenarios:

- You really have a business or any portion of possession in a corporate

- Youre a builder otherwise freelancer

- You obtain 1099 tax variations

- Youre generally a property owner

Regulations and requirements for worry about-operating individuals

In addition to showing your own a career and you may earnings, self-functioning individuals need meet standard loan credit standards. Direction differ from the financing device style of, in general, expect to have next criteria thought plus your a career and you may income:

- Credit history

- Credit history

- Newest costs (getting yourdebt-to-income proportion)

What forms of money are believed for self-functioning consumers?

Loan providers tend to normally believe any supply of recorded, taxable money which is stable and you can uniform. Self-employed earnings is viewed as alone, otherwise extra cash at the top of a primary source of income, but the majority loan providers requires at least 2 yrs off documentation.

While you are a healthcare professional, Laurel Road need files that confirms coming employment and you may secured money, instance a signed contract.

Inside the choosing qualifying money to have notice-a career, underwriters use a somewhat difficult formula. They start by your own nonexempt money, and you will create back particular deductions like depreciation, due to the fact that is not a real debts that comes off your bank account.

Confirming your self-operating money

- 2 newest years’ private tax productivity (Setting 1040)

- If the more than twenty-five% possession when you look at the a business: dos most recent years’ over organization tax returns (Form 1065 to have partnerships and you can multiple-representative LLC’s, Mode 1120S for S businesses, or Setting 1120 to possess C companies)

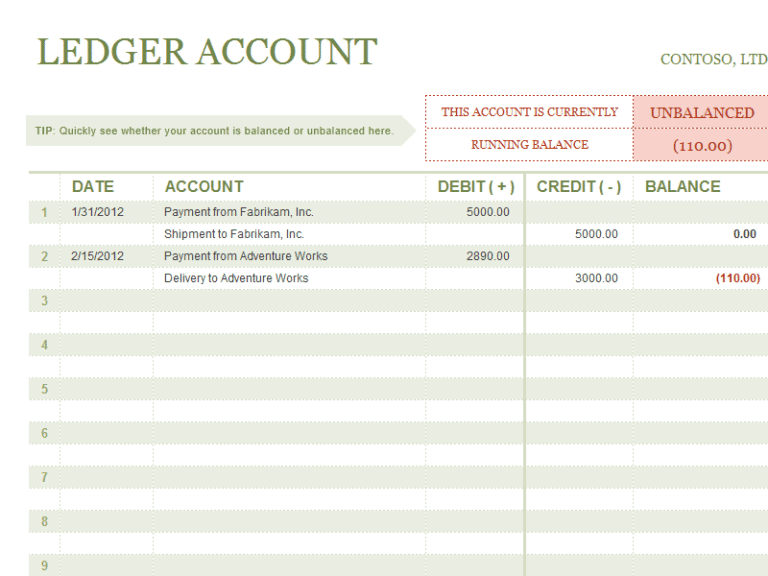

You may already have these documents prepared by your accountant, or tax preparer. Tax professionals are accustomed to these requests for mortgage loan applications and can usually provide these documents with quick turnaround. For student loan refinancing, we offer an easy-to-fool around with funds & losings theme if needed.

Discussing money inconsistencies

In case your money isnt normal and you will legitimate, loan providers essentially would not matter they. Although not, of many organizations go through downs and ups. For example, a doctor whom begins an alternative routine have a great deal off right up-top expenditures 1 year, such to acquire or leasing possessions, obtaining insurance policies, purchasing provides, software, gizmos, etc. The firm could possibly get inform you absolutely nothing income or even larger losses.

In the event the income let you know an increase or decrease in money from 20% or even more 12 months-over-12 months, anticipate to explain those individuals alter after you make an application for good mortgage given that a home-working debtor.

Perform I must declaration self-working income?

For those who have a self-employed job otherwise small business into front and you will qualify for a home loan or student loan refinance considering W-dos earnings and private offers alone – staying away from financing within the a business account – then your worry about-employed earnings can only just end up being overlooked and does not must be documented on your software.

For the majority brand new enterprises and begin-ups, extremely common to demonstrate losses in writing because of income tax write-offs and you may deductions, that may in reality reduce your qualifying income whenever trying to get an effective mortgage. Typical deductions but not, like depreciation and holder earnings, is added to your taxable money should you choose to provide oneself-a career income in your software.

Inside providing this particular article, neither Laurel Roadway nor KeyBank neither their affiliates try becoming your representative or is providing any tax, economic, accounting, otherwise legal counsel.

One third-group linked blogs is offered getting informative objectives and should not be considered since an endorsement from the Laurel Path or KeyBank from any third-class products said. Laurel Road’s On line Confidentiality Statement cannot connect with third-team linked other sites and you’ll consult the newest privacy disclosures away from for every single site you visit for further pointers.